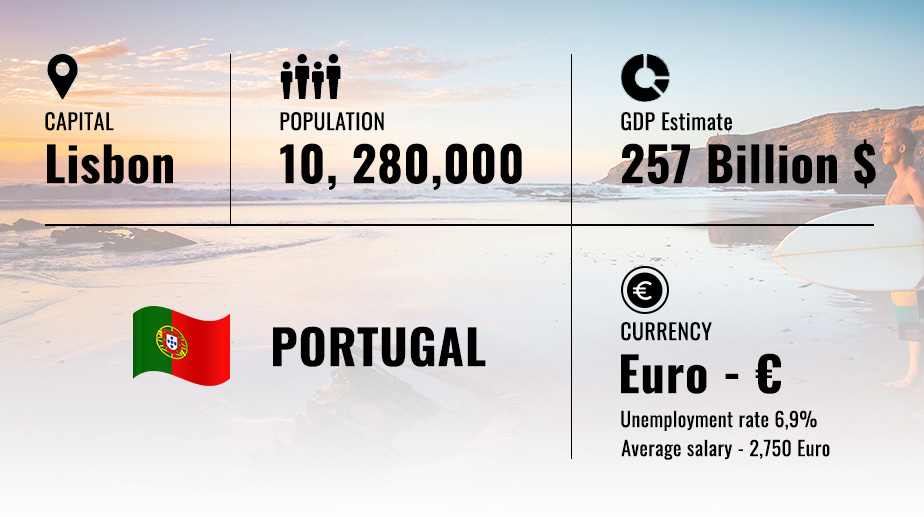

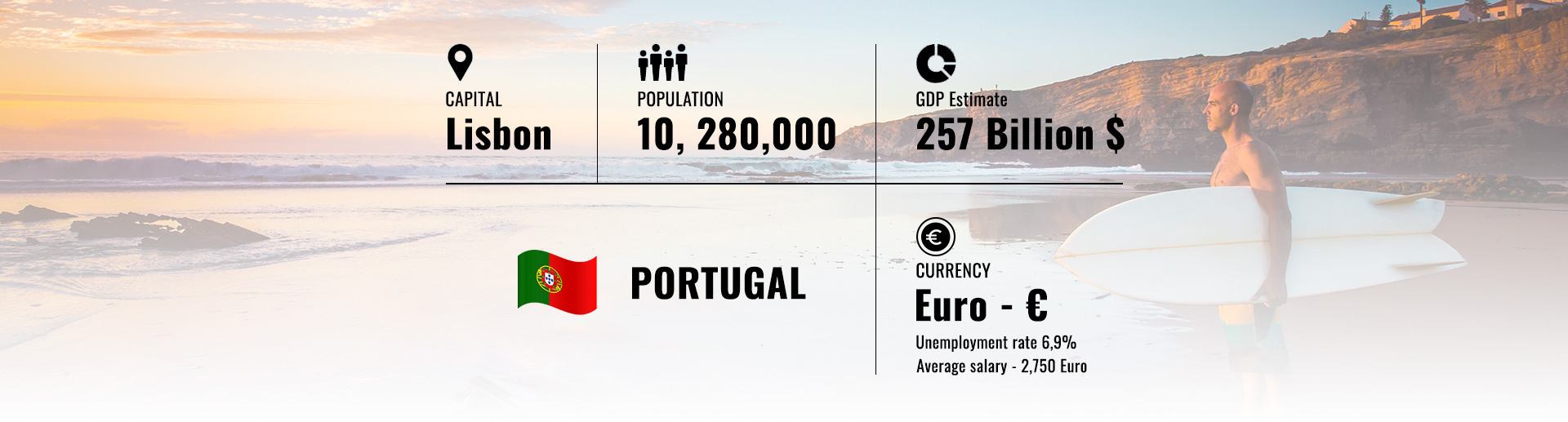

Find out why Portugal is attracting a growing number of investors, retirees, and expats from around the world.

A year-round Mediterranean climate. Dune-covered beaches with crystal blue waves. Irresistibly flaky pastel de nata tarts oozing with egg custard.

From its diverse landscapes to its fresh seafood-packed cooking, there’s a lot to love about Portugal. And as the sunny, seaside nation attracts international travelers at record-high rates, Portugal is also catching the eyes of savvy investors.

Touted as Europe’s best-kept secret, Portugal has become increasingly popular among investors, retirees, and expats from around the world.

Here are three reasons why Portugal stands out among European countries as a place to invest, live, and retire.

In addition to the opportunity to legitimately reduce your overall income tax, non-habitual residents enjoy a number of other tax benefits, including a tax exemption for gifts or inheritance to direct family and free remittance of funds to Portugal.

As a non-habitual resident, you also have the opportunity to earn Portuguese income taxed at a special flat rate of 20 percent.

You can apply for non-habitual resident status after achieving tax residency in Portugal. Residency can be established through the Golden Visa program.

To qualify for non-habitual resident status, you must not have been a Portuguese tax resident in the last five years. In addition, you must currently reside in Portugal and own or rent property in the country.

€ 220,000 - € 1,500,000

€ 500,000 - € 1,595,000

€ 820,000 - € 2,500,000

€ 400,000 - € 1,810,000

€ 493,050 - € 919,950

From €995,000